News: Dell’s 40-inch curved monitor is perfect for a home office command center

Dell’s kicking off 2021 with a new addition to its monitor lineup that aims to hit a variety of sweet spots. The Dell UltraSharp 40 Curved WUHD monitor offers 39.7″ of screen real estate, with a 5120 x 2160 resolution that matches the pixel density of 4K resolution on a 32-inch conventional widescreen display. It

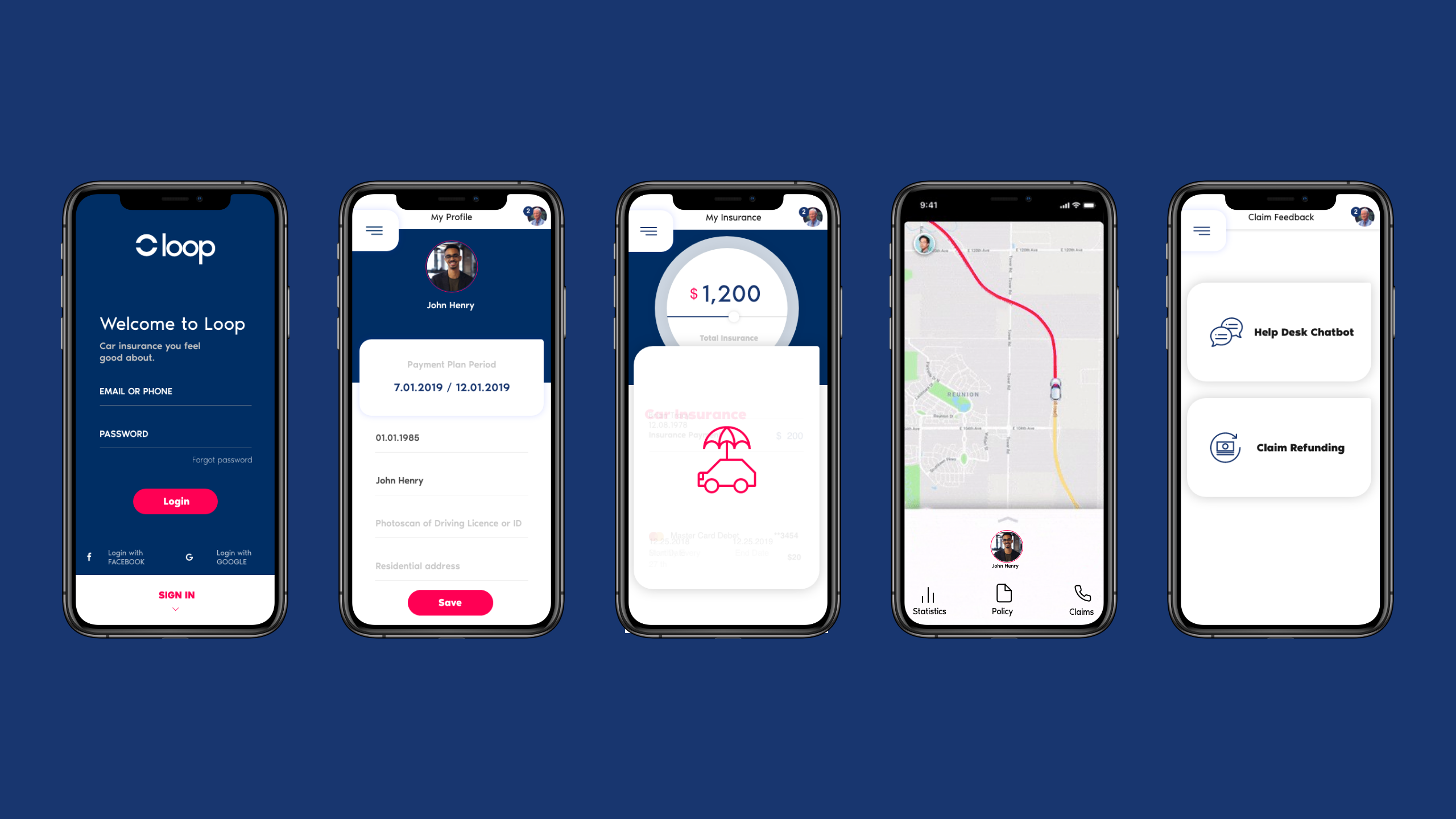

Dell’s kicking off 2021 with a new addition to its monitor lineup that aims to hit a variety of sweet spots. The Dell UltraSharp 40 Curved WUHD monitor offers 39.7″ of screen real estate, with a 5120 x 2160 resolution that matches the pixel density of 4K resolution on a 32-inch conventional widescreen display. It comes equipped with Thunderbolt 3 for display and data connectivity, as well as 90W of charging for compatible computers, and a 10Gbps Ethernet connection for networking. In short, Dell’s latest (which is available beginning January 28) looks to be a true ‘one display to rule them all’ contender, particularly for those searching for a way to optimize their home offices.

The basics

Dell’s UltraSharp 40 has a 60Hz, 39.7″ diagonal display in 21:9 aspect ratio with WUHD resolution (not quite true 5K, but exceptional for a curved monitor this size). It offers 100% sRGB and 98% P3 color reproduction, and comes with a stand that has height adjustability, tilt and swivel, and that features a hidden cable channel for cable management. Built-in speakers provide 9W each of sound reproduction so you don’t need to worry about adding externals.

Image Credits: Darrell Etherington

In terms of wired connections, it offers Thunderbolt 3, RJ45 Ethernet, and USB 10Gps ports (three on the rear, and one in front) as well as one USB-C port for easy access on the front. There’s also 3.5mm audio line out (though it’s worth noting that this doesn’t work with headphones), and two HDMI ports plus one DisplayPort for more traditional display connectivity if you’re not going the Thunderbolt route. Finally, a standard security lock slot allows you to anchor the display in any shared environment.

The display itself is bright, clear and viewable at a wide range of angles, with a more matte finish that provides excellent viewing in a wide range of lighting conditions. A joystick control button provides easy navigation and operation of the built-in on-screen menu and integrated features, including picture-in-picture.

Design and features

First and foremost, the Dell UltraSharp 40 delivered excellent visual quality. Especially for a display this size, in a curved form factor, at this resolution, it’s going to be something that satisfies everyone from telecommuters mostly handling meetings and spreadsheets, to photographers and video professionals looking for image quality that is highly color-accurate and provides crystal clear detail.

The WUHD resolution means that you can run the display in a range of different configurations, depending on how much screen real estate you want or need. For instance, I’ve been using it at the 5160 x 2160 res, and it provides ample workspace for arranging multiple windows side-by-side, and tiled vertically. I typically use three displays at once in my day job (there’s a lot of tab and browser windows involved) and the Dell UltraSharp 40 makes it so that I can comfortably work with just a single monitor instead. It’ll work with Apple’s HiDPI modes on its modern Macs for clear and crisp visuals with larger on-screen elements, too, however, if you don’t need all that room.

Dell’s integrated stand is simple and effective, providing a range of maneuverability options that allow for significant travel in height adjustment. You won’t get a portrait mode full swivel in this display – but that’s not surprising given how long it is on its longest edge, compared to the vertical. You do get tilt if you need it, and the ability to angle back and forwards depending on how you have it positioned. The end result is a display that’s very large, but easy enough to adjust for your comfortable use.

Image Credits: Darrell Etherington

The display comes calibrated out of the box, but also includes plenty of options for adjusting things like contrast and brightness using the built-in menus. This also including a very useful multi-device display setup, including both picture-in-picture features for multiple sources, and a picture-by-picture mode that splits the display into two equal side-by-side sections for multiple inputs. Another useful feature for working with the display with multiple computers: keyboards and mice connected via the monitor will automatically detect and switch between controlling both connected PCs.

Besides the display size and resolution, the other thing that makes the UltraSharp 40 a fantastic option for a home workstation is its range of ports and added bonuses like built-in speakers. The speakers aren’t going to win any audiophile awards, but they’re better than the ones that come built into your laptop and they obviate the need for additional equipment if you’re looking to spare your desk surface space. With any modern Thunderbolt-equipped Mac, the Dell UltraSharp 40 really is a one-cable wonder that offers very little in the way of compromises.

Bottom line

Image Credits: Darrell Etherington

With the Dell UltraSharp 40, the company continues its tradition of delivering extremely high-quality display products at a reasonable price. The $2,100 price tag may seem steep, but for what you’re getting it’s a very fair price point, and Dell’s displays also have very high reliability that means an investment in their monitors is likely to keep you satisfied for many years to come (two of my home office displays are some of Dell’s very first 4K monitors, which have served me reliably for over half a decade).

Because of its wide aspect ratio and curve, this display really does replace two smaller 4K screens for most uses, and so the cost framed that way actually makes even more sense. In short, Dell’s UltraSharp 40 is a home office beast, which fills a sweet spot for a wide range of remote professionals.