- November 13, 2020

- by:

- in: Blog

Eighteen months ago, Uber’s self-driving car unit, Uber Advanced Technologies Group, was valued at $7.25 billion following a $1 billion investment from Toyota, DENSO and Softbank’s Vision Fund. Now, it’s up for sale and a competing autonomous vehicle technology startup is in talks with Uber to buy it, according to three sources familiar with the

Eighteen months ago, Uber’s self-driving car unit, Uber Advanced Technologies Group, was valued at $7.25 billion following a $1 billion investment from Toyota, DENSO and Softbank’s Vision Fund. Now, it’s up for sale and a competing autonomous vehicle technology startup is in talks with Uber to buy it, according to three sources familiar with the deal.

Aurora Innovation, the startup founded by three veterans of the autonomous vehicle industry who led programs at Google, Tesla and Uber, is in negotiations to buy Uber ATG. Terms of the deal are still unknown, but sources say the two companies have been in talks since October and it is far along in the process.

An Uber spokesperson declined to comment, citing that the company’s general policy is not to comment on these sorts of inquiries. An Aurora spokesperson said it doesn’t comment on speculation.

The talks could falter. But if successful, they have the potential to triple Aurora’s headcount and allow Uber to unload an expensive long-term play that has sustained several controversies in its short life.

Uber has ‘been shopping’

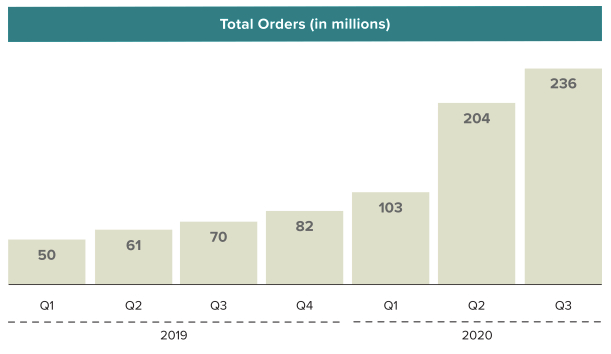

Shedding Uber ATG would follow a string of spin offs or other deals in recent months that has narrowed Uber’s focus and costs into core areas of ride-hailing and delivery. Two years ago, Uber’s business model could be described as an “all of the above approach,” a bet on generating revenue from all forms of transportation, including ride-hailing, micromobility, logistics, package and food delivery and someday even autonomous robotaxis.

That strategy has changed since Uber went public and has further accelerated as the COVID-19 pandemic has upended the economy and fundamentally changed how people live. In the past 11 months, Uber has dumped shared micromobility unit Jump, sold a stake in its growing but still unprofitable logistics arm, Uber Freight and acquired Postmates. (The Postmates acquisition is expected to close in the fourth quarter of 2020).

Uber ATG has been the company’s last big, expensive holding. Uber ATG holds a lot of long-term promise and high present-day costs; Uber reported in November that ATG and “other technologies” (which includes Uber Elevate) had a net loss of $303 million in the nine months that ended September 30, 2020. In its S-1 document, Uber said it incurred $457 million of research and development expenses for its ATG and “other Technology Programs” initiatives.

Four sources within the industry told TechCrunch that Uber “has been shopping” ATG to several companies, including automakers this year. Sources have also told TechCrunch that Uber ATG was facing a potential down round, which might have been an additional motivator behind the talks with Aurora.

Aurora, which was founded in 2017, is focused on building the full self-driving stack, the underlying technology that will allow vehicles to navigate highways and city streets without a human driver behind the wheel. Aurora has attracted attention and investment from high-profile venture firms, management firms and corporations such as Greylock Partners, Sequoia Capital, Amazon and T. Rowe Price, in part because of its founders Sterling Anderson, Drew Bagnell and Chris Urmson.

Urmson led the former Google self-driving project before it spun out to become the Alphabet business Waymo. Anderson is best known for leading the development and launch of the Tesla Model X and the automaker’s Autopilot program. Bagnell, an associate professor at Carnegie Mellon, helped launch Uber’s efforts in autonomy, ultimately heading the autonomy and perception team at the Advanced Technologies Center in Pittsburgh.

Aurora has grown from a small upstart to a company with 600 employees and operations in the San Francisco Bay Area, Pittsburgh, Texas and Bozeman, Montana, home of Blackmore, the lidar company it acquired in 2019. About 12% of Aurora’s current workforce previously worked at Uber, according to records on LinkedIn.

Despite that growth, Aurora is still dwarfed by Uber ATG, the self-driving subsidiary that is majority owned by Uber. Uber ATG has more than 1,200 employees with operations in several locations, including Pittsburgh, San Francisco and Toronto. Uber holds an 86.2% stake (on a fully diluted basis) in Uber ATG, according to filings with the U.S. Securities and Exchange Commission. Its investors hold a combined stake of 13.8% in Uber ATG.

Uber’s public leap into autonomous vehicle technology began in earnest in early 2015 when the company announced a strategic partnership with Carnegie Mellon University’s National Robotics Center. The agreement to work on developing driverless car technology resulted in Uber poaching dozens of NREC researchers and scientists. A year later, with the beginnings of an in-house AV development program, Uber, then led by co-founder Travis Kalanick, acquired a self-driving truck startup called Otto.

The acquisition was troubled almost from the start. Otto was founded earlier that year by one of Google’s star engineers Anthony Levandowski, along with three other Google veterans: Lior Ron, Claire Delaunay and Don Burnette. Uber acquired Otto less than eight months later.

Two months after the acquisition, Google made two arbitration demands against Levandowski and Ron. Uber wasn’t a party to either arbitration. While the arbitrations played out, Waymo separately filed a lawsuit against Uber in February 2017 for trade secret theft and patent infringement. Waymo alleged in the suit, which went to trial but ended in a settlement in 2018, that Levandowski stole trade secrets, which were then used by Uber.

Under the settlement, Uber agreed not to incorporate Waymo’s confidential information into their hardware and software. Uber also agreed to pay a financial settlement that included 0.34% of Uber equity, per its Series G-1 round $72 billion valuation. That was calculated at the time to be about $244.8 million in Uber equity.

In the early days of the Otto acquisition, Uber estimated it could have 75,000 autonomous vehicles on the roads by 2019 and be operating driverless taxi services in 13 cities by 2022, according to court documents unsealed and first reported on by TechCrunch. To reach those ambitious goals, the ride-hailing company was spending $20 million a month on developing self-driving technologies.

Uber never came close to hitting those targets, a mission that was derailed by technical hurdles as well as the lawsuit with Waymo, its troubled relationship with Lewandowski and the fatal crash in March 2018 involving one of its self-driving test vehicles in Tempe, Arizona.

Uber halted all testing following the crash and has been slowly ramping up its more public-facing operations over the past 18 months. The expensive undertaking of developing autonomous vehicles prompted Uber to spin out the company in spring 2019 after it closed $1 billion in funding from Toyota, auto parts maker Denso and Softbank’s Vision Fund.

The spin out, which occurred about one month before Uber’s debut as a publicly traded company, had been the subject of speculation for months. It was seen as a way for Uber to share the expensive load with other investors and allow it to focus on its core competencies and nearer term profit goals.

What Aurora gains

Troubles aside, Uber ATG has two important and critical features that make it attractive to Aurora: talent and Toyota.

The Japanese car giant had already invested $500 million into Uber prior to the 2019 injection of cash. At the time, the two companies announced their intention to bring pilot-scale deployments of automated Toyota Sienna-based ridesharing vehicles to the Uber ridesharing network in 2021, “leveraging the strengths of Uber ATG’s self-driving technology alongside the Toyota Guardian advanced safety support system.”

The 2019 investment into the Uber ATG unit deepened Toyota’s relationship with the company.

“While Uber was facing off against Waymo in the trade secrets lawsuit, Aurora launched with a bang. Within 18 months, Auora had secured several kinds of partnerships with Hyundai, Byton and VW Group. Some have fizzled, while there have been new gains, notably with Fiat Chrysler Automobiles. The musical chair-like changes underscores the sheer number of hopeful players in the self-driving business — a market that is still full of commercial and technical unknowns — and the fickleness of incumbent car makers in search of the best tech and deal.”

VW Group, which had touted its Aurora partnership in January 2018, confirmed to TechCrunch in June 2019 that “activities under our partnership have been concluded.” VW Group ultimately put its capital behind Argo AI, another autonomous vehicle technology developer that had locked up backing and a customer deal with Ford.

While Hyundai does have a minority stake in Aurora, it also went ahead and locked in a joint venture in fall 2019 with autonomous driving technology company Aptiv. Under the deal with Aptiv, both parties took a 50% ownership stake in the new joint company that is now called Motional. The combined investment in Motional from both companies will total $4 billion in aggregate value (including the value of combined engineering services, R&D and IP).

Still, Aurora has had its wins. The company raised $530 million last spring in a Series B round led by Sequoia with “significant investment” from Amazon and T. Rowe Price. Aurora’s post-money valuation at the time was $2.5 billion. More recently, sources in the industry say that Aurora is abuzz with activity, particularly around the office of David Maday, the company’s new vice president of business development who led General Motors’ corporate development and mergers and acquisitions team for 21 years.

Aurora has always stated that its full driving stack — the combined suite of software and hardware that provides the brains for an AV — would be vehicle agnostic, but some of its early testing and partnerships suggested it was focused on robotaxi applications, not logistics. Aurora started talking more openly last year about applying its technology to long-haul trucking and has become more bullish on that application, particularly following its Blackmore acquisition.

Aurora announced in July 2020 that it was expanding into Texas and planned to test commercial routes in the Dallas-Fort Worth Area with a mix of Fiat Chrysler Pacifica minivans and Class 8 trucks. A small fleet of Pacificas were expected to arrive first. The trucks will be on the road in Texas by the end of the year, according to the company.

The Jump precedent

What’s unclear is how an acquisition of Uber ATG might be structured; and more importantly, if it will retain any interest in the enterprise. Even with the expected depletion in Uber ATG’s valuation, it would be seemingly out-of-range for Aurora unless it was able to secure additional outside investment or structure the deal in a way that would allow Uber to keep some equity.

There is precedent for the latter. Earlier this year, Uber led a $170 million investment round into Lime. As part of the complex arrangement, Uber offloaded Jump, the bike and scooter-sharing unit, to Lime.

Rumors that Uber CEO Dara Khosrowshahi was keen to get rid of Uber ATG have popped up from time to time in the past year. But as the COVID-19 pandemic took hold, Khosrowshahi and other executives began to focus on its core competency of ride-hailing and double down on delivery. In addition to its micromobility unit and the Uber Freight spinoff, it has divested itself internationally of a number of regional operations that were proving too costly to grow in competition with strong local rivals.

It was on the heels of the Jump deal that interest in selling off Uber ATG ramped up, according to two sources.

One investor in the industry described it as an interesting plan b for Uber, a deal that would allow the company to take ATG off the books, while potentially getting to benefit from a little of upside.